What is the deficit and the national debt? Are they as huge as people say? Is this really another "crises"? Or like most government "crises" is it just politicians trying to get everyone alarmed, in order to get elected?

There is a lot of talk this election year - and rightfully so - about the deficit and national debt. A lot of people don't understand the difference between the two, even as they have strong opinions about the matter.

(In fact, some people don't even know what a Billion is (a thousand million) or a Trillion (a thousand Billion) and come up with all sorts of cooked numbers when discussing this issue. A common trick is to count a Billion as a million million which of course throws everything off by a factor of 1,000).

The deficit, of course, is how much more the government is spending than it is taking in, in revenues. The national debt is the accumulated debt as a result of this deficit spending.

Why do we have budget deficits and a national debt? The first is a result of both increased spending and decreased income. In good times, people make more money and the government collects more taxes. During the Clinton years, we had budget surpluses (but did not pay off the national debt, of course) because the economy was doing well - so the IRS collected more money. Tax rates, on the very wealthy, were higher then as well.

During the Bush administration, these surpluses evaporated. Part of this was due to the two wars we were fighting, as well as the massive amounts of money thrown at "homeland security". And part of this was just spending on all sorts of projects, which Congress just couldn't control, and the White House did not make a priority. And also part of this was due to the Bush Era Tax Cuts which cut revenues at a time when spending was higher.

In the last four years, things have gone from bad to worse, in terms of budget deficits and the overall national debt. Income is down, because of the recession. People make less money, so they pay less to the IRS. The Bush Era Tax Cuts have not helped any - and some say that eliminating these would eliminate or reduce the defict. Increased spending, in the form of unemployment benefits as well as other benefits to the poor (of which there are more, because we are in recession) haven't helped, of course.

And stimulus spending adds to the balance as well - although some economists would argue that such stimulus results in a faster economic recovery, and thus will lead to improved revenues down the road. Think of this in business terms. If you want to make money running a business, sometimes you have to borrow money from the bank to invest in new machinery and technology. When you borrow this money, it often means your business balance sheet doesn't look as good the next day. But down the road, once you start making more money from this investment, you can pay back the loan and then some.

That's the theory, anyway.

But what are the actual amounts of the deficit and the national debt, and should we be concerned about them? What have these deficits been like, historically? Let's take a look.

How much is the deficit?

That data, of course, is outdated. This spreadsheet from the Office of Management and Budget, shows more up-to-date numbers. During the Bush years, the deficit went from surplus to a high of about a half-trillion a year. Since the recession, this has ballooned into about 1.2 trillion.The Congressional Budget Office predicts the deficit for the full year, which ends on Sept. 30, will total $1.17 trillion. That would be a slight improvement from the $1.3 trillion deficit recorded in 2011, but still greater than any deficit before Obama took office.One positive sign this year is the deficit is growing more slowly than last year.

The GOP is right that the deficit has ballooned over the last four years. But with reduced revenues, extension of the Bush tax cuts for the wealthy, and a crappy economy, could this really have been avoided entirely? I think not. Even with deficit hawks in the White House and Congress (good luck with that, the GOP is as pork-barrel as the Democrats are) they might have been able to reduce to this to say, maybe 1 trillion even. And then, only at the expense of a slower and more agonizing recovery.

So, much is the national debt?

At the end of September 2012, debt held by the public was approximately $11.311 trillion or about 72% of GDP. Intra-governmental holdings stood at $4.848 trillion, giving a combined total public debt of $16.159 trillion. As of July 2012, $5.3 trillion or approximately 48% of the debt held by the public was owned by foreign investors, the largest of which were China and Japan at just over $1.1 trillion each.Are these numbers to be concerned about?

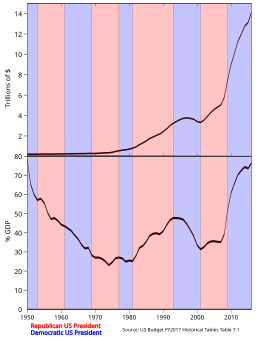

This chart illustrates the national debt, over time, as a percentage of Gross Domestic Product:

As you can see, as a percentage of GDP, our national debt is not really as scary as $16 Trillion sounds. In fact, it is really right in line with what you would expect during a recession, and compared to the last few decades.

The GOP, of course, prefers to look at the debt in terms of actual dollar amounts, as opposed to percentage of GDP, as it makes for scarier charts, and it is, after all, nearly Halloween. But of course, a dollar today is worth far less than a dollar in 1945, and that is one reason why the comparison to GDP is often more illuminating.

And of course, the ratio to GDP will drop dramatically once the GDP increases - as we recover from recession.

This chart illustrates the amount of the National Debt, both in % of GDP and in dollar amounts. For some reason, the chart is overlaid by who is President (like that makes a difference, Congress passes budgets, not Presidents!):

As you can see the upper chart, in dollars, is far more alarming than the lower one. Democrats use the lower chart, Republicans the upper one, to make their points. As for the national debt growing or receding based on who is in the White House, I see no pattern here, nor a causal relationship. Congress passes budgets, not the President.

Another way to look at the debt is by dividing it up by the number of people in our country. We are a nation of about 330 million people (about 1/3 Billion) depending on whose numbers you use. And that right there is one thing to take into account when looking at these numbers. We are a huge country, in terms of size, population size, wealth, and economic power. We are the largest economy in the world.

So you have to take that into consideration when looking at numbers like this. An annual budget deficit of 1.3 Trillion dollars sounds like a lot of money, but it works out to about $3900 per citizen in this country. Yes, that is a lot of money we have to somehow make up, over time.

The national debt, at $16 trillion, comes to about $53,000 per citizen, or a hefty mortgage on each of us. But like any mortgage, it doesn't have to be paid off all at once, but over time. And like with the GDP ratio, one way to reduce the amount of debt per citizen is to increase the number of citizens. As the population increases, these amounts per person could go down. Growth is ultimately the best way out of recession, not cutting back.

As I look at our debt, from the charts above, I come to some interesting conclusions:

1. Our nation has been in debt pretty much since its inception.

2. We very rarely have "paid down" the debt by very much, since WW II, except briefly in the Clinton years.

3. Decreasing the deficit, in the past, was accomplished by increasing revenues, not by cutting spending. Spending, historically, has always gone up. See the OMB Spreadsheet. The idea that we can "cut spending" is nonsense - at best, we can arrest its growth rate, somewhat.

4. Our National Debt, while large, is financed at some of the lowest interest rates in history.

5. Over time, our country outgrows its debt, as our economy grows and as inflation eats into it.Thus, the idea of us "paying back" the entire national debt is probably a fantasy and will never happen in our lifetimes. What will happen, of course, is that as our economy recovers, the size of the debt, as compared to GDP, will shrink, and people will worry less about it.

A note about interest rates: The last time the "national debt" was a huge political issue (as opposed to a general, every-four-years issue) was in 1980. Back then, our debt was a lot less, but thanks to high interest rates, the amount we spend servicing the debt had ballooned. A lot of our debt today is financed on long-term treasury notes that have fairly low interest rates extending out over 10, 20, or even 30 years. We are in better shape than in 1980, in this regard.

A note about "Debt Clocks": In researching this article, I found a lot of sites, mostly right-wing, with various "debt clocks". One site has about 50 of these various clocks, which are all spinning in an alarming manner, which induces a kind of panic in the viewer. These are less than illuminating, as spinning numbers are just dramatic, and not really useful for mathematical analysis. And often these "debt clock sites" take things like "all unfunded liabilities" (which I guess would include all medicare and Social Security, potentially paid out from now until 2065) and then make the argument that our "total liabilities" are well over $100 Trillion Dollars !!!! (with lots of exclamation points!!!) But these sort of specious calculations and spinning numbers prove little or nothing. But they do make an emotional hook into the viewer, as they induce a sense of anxiety and panic in the viewer. No wonder the "debt clock" was the centerpiece of the GOP convention. Again, when someone tries to sell you fear they are selling you a wagon-load of horseshit, whether it is "buy a house now, before you get priced out of the market!" or "The debt will explode if you don't elect me!"

But what about all those foreigners who are holding our debt notes? Romney and the GOP make a big issue of this - that the Chinese are "holding a trillion dollars of our debt" - as if they are going to foreclose on us, and repossess Air Force One. But of course, it isn't quite like that. Anyone can buy U.S. Government debt instruments. You can go online right now and buy T-bills or bonds, as I have written about before. They are a pretty crappy investment, right now.

So is this something to worry about? All those Chinese holding our low-interest-rate notes? I think not, and for several reasons:

First, we can't limit who buys our debt. It isn't practical to do that.

Second, allowing overseas investors to buy our debt brings down the interest rates on our debt.

Third, holding our debt instruments doesn't mean the Chinese (or anyone else) can "foreclose" on the USA or repossess it, or that they have some sort of hold over us. I own a t-bill, it gives me no special rights, believe me.

Fourth - and most importantly - the reason so many foreigners are holding our debt notes is that it is considered to be one of the safest investments on the globe, even if it pays bubkis in interest. And that should tell you a lot, right there. While the GOP doesn't have confidence in our country, the rest of the world does.So why does the GOP make a big deal about "China holding $1 Trillion of our debt?" Well, it sounds scary to the plebes. Selling fear, yet again! They talk as though we are enriching them with a 2% rate of return or something. It is a bullshit argument, and when someone makes a bullshit argument, well, you know where things are headed. They are lying to you - for a reason.

So, does this mean we should not be concerned about the deficit or the national debt? Of course not. It is an important issue - but you have to separate fact from fiction and scare stories from actual truth. And this being an election year, it is easy to spread scare stories about the debt - every party does it, every four years.

Believe it or not, Obama ran on this issue as well, pointing out how Bush increased the deficit and the national debt. And of course, Republicans, at the time, said, "Well, we had two wars going on! A war on terror! We had to spend the money!" But some would argue that $1.9 Trillion of that money went to the wrong war - invading Iraq, instead of Afghanistan. And now there is talk of attacking Iran. Who knows? Maybe it was worth it - maybe the "Arab Spring" uprisings would not have taken place, if not for the Iraq war. Or maybe they would have, and Saddam would have been overthrown anyway. You can't unbark the dog.

I think the fantasy the GOP is selling is that we can actually decrease the budget over time, and thus spend less (except on defense of course! We need to increase that!) while lowering taxes and decreasing the deficit and actually paying down the national debt. That last item is a real whopper, if you look at the charts above. Only during the Clinton years did we ever do that, and even then, by a trivial amount.

I think a better goal is to continue to reduce deficits over time, as the economy recovers, by keeping spending increases in check, and by increasing revenues by allowing the Bush Tax Cuts for his Wealthy Buddies to expire. We got along just fine in the Clinton years, with the old tax rates - we can do it again. It just means that Muffy can't have a new helicopter for her Sweet-16 party.

As for the National Debt, the best we can do (and should do) in the next decade, is to arrest its rate of growth. Paying it down is an infantile fantasy - and a basic LIE, used to get the plebes all riled up for the election.

And that is the whole point, really - to get elected. We will recover from this recession, come hell or high water. The USA is not having a "going out of business sale" anytime soon. And as the economy recovers and the government's income increases, we will see these deficits shrink and the ratio of the national debt to GDP decrease. And whoever is in the White House when this happens, will claim credit for it and say it was their idea.

So, now you understand why Romney isn't more specific about his plans. He needn't be. Why box yourself in by promising anything more specific than cutting funding for PBS? If you say you will do X, then your opponent will call you out on it, in four years, if you don't - just as Romney is going through everything Obama said and criticizing him for not following through (why Obama decided not to lower unemployment rates is beyond me! If I were President, I would select a lower rate - as well as lower gas prices. I mean, it is a no-brainer, right? Sheesh!).

So the real race here is the race for who gets credit for the inevitable recovery. And if Obama does it, he will be lauded as a visionary. And if Romney does it, he will get credit for his "financial acumen". But in either case, there are greater forces at work than the actions of an individual President, whose powers are really limited, in terms of what they can accomplish, with a balky Congress to deal with.

No comments:

Post a Comment